MOOSE JAW — Taxpayers owed more than $4 million in total tax arrears at the end of the second quarter, which was nearly 20-per-cent more than Q2 2024, although more people participated in payment plans.

City administration presented the second-quarter financial report during the Aug. 25 regular city council meeting, which included data about tax arrears, outstanding debt and how much each property class owed.

Council voted unanimously to receive and file the report.

Property tax arrears

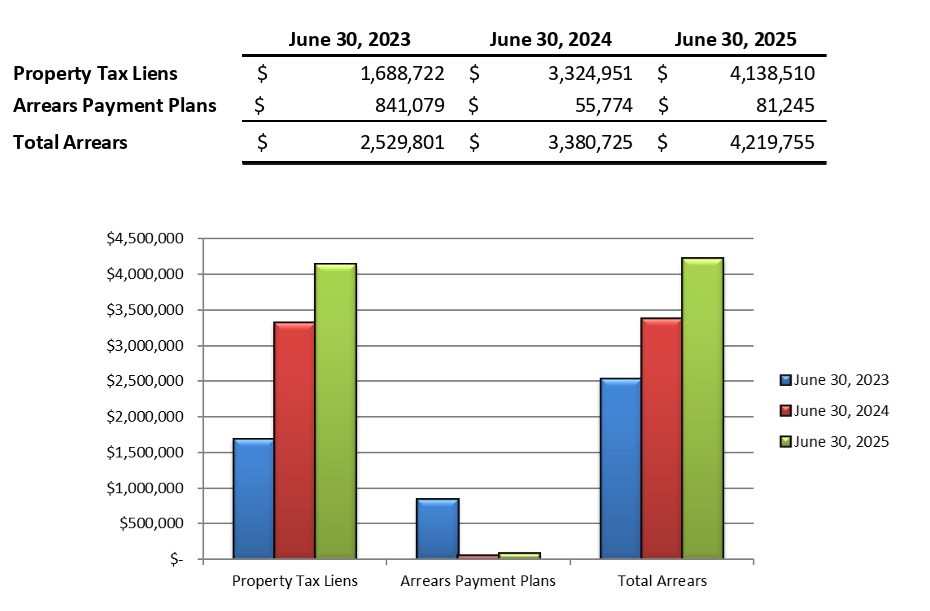

As of June 30, taxpayers owed $4,219,755 in total arrears, which included $4,138,510 in property tax liens and $81,245 in arrears payment plans, the report said.

Conversely, by June 30, 2024, those numbers were, respectively, $3,380,725, $3,324,951 and $55,774.

Therefore, the total outstanding amount of tax arrears increased by $839,030 — a jump of roughly 19.88 per cent — from Q2 2024 to Q2 2025. This comprised a year-over-year increase in liens of $813,559 and an increase in payment plans of $25,471.

Meanwhile, by June 30, 2023, taxpayers owed $2,529,801 in total arrears, including $1,688,722 in property tax liens and $841,079 in payment plans.

Property taxes receivable

Property taxes receivable consists of tax arrears and taxes owing. Tax arrears are overdue taxes, while current taxes are due but have not fallen into arrears. Taxes fall into arrears in the next year following the levy of taxes.

The total outstanding property taxes receivable by June 30 was $23,198,339, which was comprised of all outstanding arrears.

In comparison, total property taxes receivable that were outstanding by the end of Q2 2024 were $20,574,055, followed by minus-$24,643,532 in 2023, $16,534,844 in 2022, $30,172,095 in 2021 and $27,432,046 in 2020.

Arrears by property class

At the end of 2024, the five main property classes owed $2,013,771.08 in outstanding arrears, followed by $1,029,482.78 in 2023 and $1,095,256.43 in 2022, the report said. This means those classes owed $4,138,510.29 during the last three years, while including payment plans of $81,245.13 increased the total to $4,219,755.42.

The taxes missed in 2024, 2023 and 2022 were:

- Other agricultural: $3,985.99 / $0 / $0

- Commercial/industrial: $708,793.59 / $411,041.69 / $223,379.58

- Multi-unit residential: $203,370.62 / $101,266.54 / $62,234.55

- Residential: $1,097,620.88 / $517,174.55 / $809,642.30

Compared to commercial/industrial, residential comprised roughly 45 per cent of outstanding arrears by property class in Q2 2025, the report said.

Tenders

City hall issued 15 tenders worth $3,849,390.07 for several projects during the second quarter, including for a new roadway grader, Yara Centre turf replacement, rubber tire excavator, trucks, new playground equipment at the Knights of Columbus Park, interior renovations at city hall, concrete work and repairs to the Cultural Centre basement.

Borrowing/debt

As of June 30, city hall was still repaying on six projects after borrowing money to finance them.

The principal outstanding amount on each project was:

- Multiplex long-term loan: $9,916,000

- Waterworks capital long-term loan: $18,626,000

- High-service pumphouse: $6,534,000

- Buffalo Pound Water Treatment Corporation (BPWTC) loan term loan (Bank of Montreal): $9,177,480

- Buffalo Pound Water Treatment Corporation loan term loan (TD Bank): $13,515,836.10

- Buffalo Pound Water Treatment Corporation loan term loan (Royal Bank of Canada): $14,018,716.16

These projects totalled $71,788,032.26, a decrease of $1,145,336.95 from the end of the first quarter. Meanwhile, the City of Moose Jaw’s debt limit is $95 million.

The next regular council meeting is Monday, Sept. 8.