Carrot River has passed a budget that prepares the town for the construction of a new subdivision – and it has done so without knowing the exact revenues it will receive in 2017.

Bob Gagné, Carrot River’s mayor, said in many ways, the budget is routine except when it comes to the new development.

“It’s an exciting budget because of the fact that we’re trying to hold our spending down while trying to expand our town so we’re viable in the future,” he said after the March 15 council meeting.

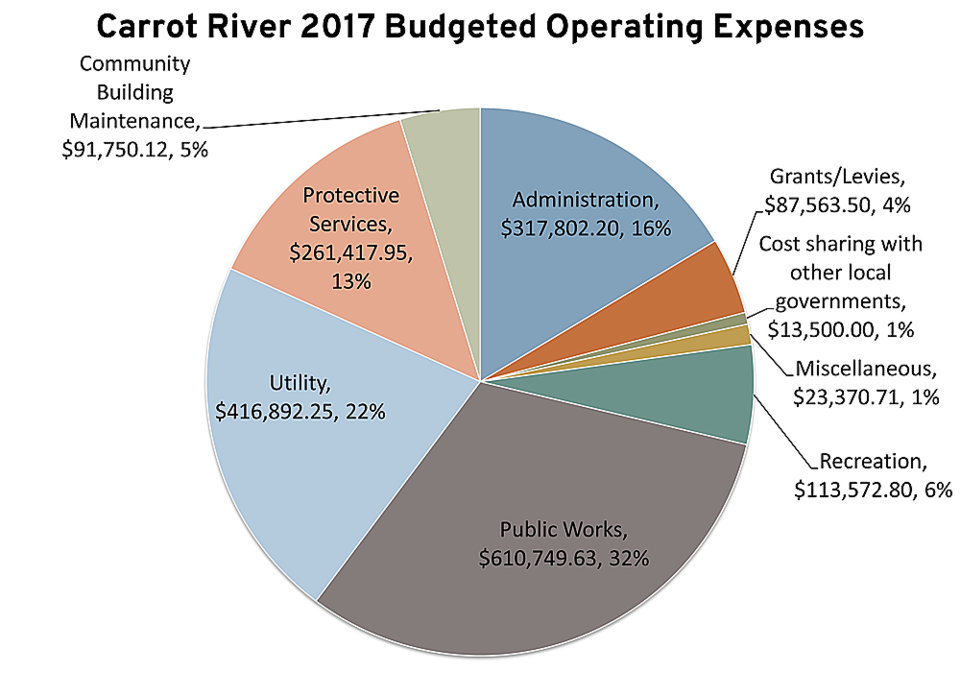

For its operating budget, the town expects to spend $1.94 million, with almost $611,000 devoted to public works, $318,000 to administration, $417,000 to utilities, $261,000 to protective services, $114,000 to recreation, $92,000 towards maintenance of community buildings, $88,000 towards grants and levies, $23,000 towards miscellaneous expenses and $13,500 towards cost sharing agreements with local governments.

For its capital budget, the town expects to spend $1.9 million. That includes $950,000 budgeted for the new subdivision, $600,000 for a new sewage lift station, $52,000 for community hall renovations, $50,000 for sidewalk replacement, $40,000 for town hall renovations, and $38,000 for hydrants. The town will also talk with the RM of Moose Range about splitting the cost for a side-by-side ATV for the fire department, which the town would pay $20,000, as well as a hose repair machine for $10,000.

Earlier budgets

This is the first year the town has passed the budget without having the exact tax and government grant revenues confirmed.

Kevin Trew, the town’s administrator, said it’s part of an effort to have the town’s budget ready and passed by the end of the calendar year in 2020 so the town can improve its financial planning.

“How that would look is we would actually head into our calendar year with some knowledge of how we are going to spend money for the next year so that council could approve something before year-end for the next calendar year and that staff could then act accordingly,” he said. “It’s always seemed a bit backwards to council members and myself that we don’t approve a budget until early to mid-April, at which time a third of a year already went by.”

Trew said he sees earlier budgets as a way to ensure that council has better control over spending, as it is tasked with according to provincial legislation.

With the town having an unexpected $154,000 deficit last year, Gagné said he wants to see the town be more careful with spending.

“Unfortunately last year we had a deficit budget because of the flooding, so this year, we’re planning to get back on track with a balanced budget,” he said. “Everyone’s been told to watch their spending and abide by their budgets.”

The mayor said the town is expected to get reimbursed for that deficit by the Provincial Disaster Assistance Program.

Trew said the town plans to have its budget passed one month earlier each year until 2020.

Taxes to be determined

As for how much tax Carrot River residents will have to pay this year, that’s something that still has to be calculated. The Saskatchewan Assessment Management Agency has not given the town the assessment values for each property in town yet – partially because it’s a reassessment year.

The town is also planning to change how it calculates taxes, going from a minimum tax system – where a taxpayer has to pay according to a proportion of their property’s assessed value, with a minimum that each must pay – to a base tax system, where each taxpayer pays a flat fee and then pays a certain proportion of their property’s assessed value on top of that.

Gagné said taxpayers shouldn’t see too many changes in what they pay.

“I would say one of the highlights is there’s no big tax increase for the average citizen – no big tax increase. We’re trying to keep it to the equivalent to what it was last year.”

Trew said the town will have to raise more tax revenue than last year, but there’s some newly-constructed buildings that will start paying tax this year. On the other hand, the removal of two elevators in town will change the assessments of those properties.

Council will still have to approve the final tax levy – and if the budget means that it would be too high, making changes to it and reducing spending is still an option.

.png;w=120;h=80;mode=crop)

.png;w=120;h=80;mode=crop)