The Comfort Inn and Suites was the location for a series of helpful small business-focused seminars titled Taxes over Breakfast.

The morning presentations were organized by the Battlefords Chamber of Commerce as part of Small Business Week. Each of the sessions focused on different tax topics, with each one having a focus on municipal/property taxes that businesses face annually.

SAMA

The first two sessions on Wednesday and Thursday featured Chandra Reilly, regional manager of the Saskatchewan Assessment Management Agency. Her first session on Wednesday focused on an overview of assessment and the three approaches to value – the cost approach, the sales-comparison approach (mainly used for residential/multifamily) and income approach.

Right now the cost approach to assessment is the one used in both North Battleford and Battleford. According to SAMA’s website, the cost approach estimates the replacement cost of a building, less depreciation, adding land values based on sales.

The income approach to assessing commercial property has been much-discussed over the past few years among members of the chamber, with talk about the city possibly switching over from the current cost approach. The income approach uses the building’s income from rentals in the assessment of property values.

Reilly explained the income approach is seen as more accurate in assessing market value for properties such as hotels, malls, apartment buildings and so on. However she made it clear that instituting that approach requires data and information. It requires a minimum of three years of income expense information, as well as enough of that information to statistically test it. Very accurate sales data is also required, she said.

The City of North Battleford has indicated a desire to bring in the income approach, and SAMA had hoped to collect that information in July for a possible switch in 2021.

But a hoped-for mailout to businesses to gather information did not happen in time, which means the city will remain on the cost approach for the foreseeable future. SAMA is now looking at possibly bringing in the income approach in North Battleford for 2025 at the earliest. The indication from Reilly at the morning presentation is they hope to start sending out mailouts in the near future to collect the information they need.

But Reilly noted SAMA might still not be able to institute the income approach, even after all that work.

“We could go through all of this collection, all of this research and analysis to find that the income approach can’t be applied,” Reilly said.

Reilly presented again on Thursday morning, this time on the topic of what triggers a property review and the appeals process.

Municipal taxes

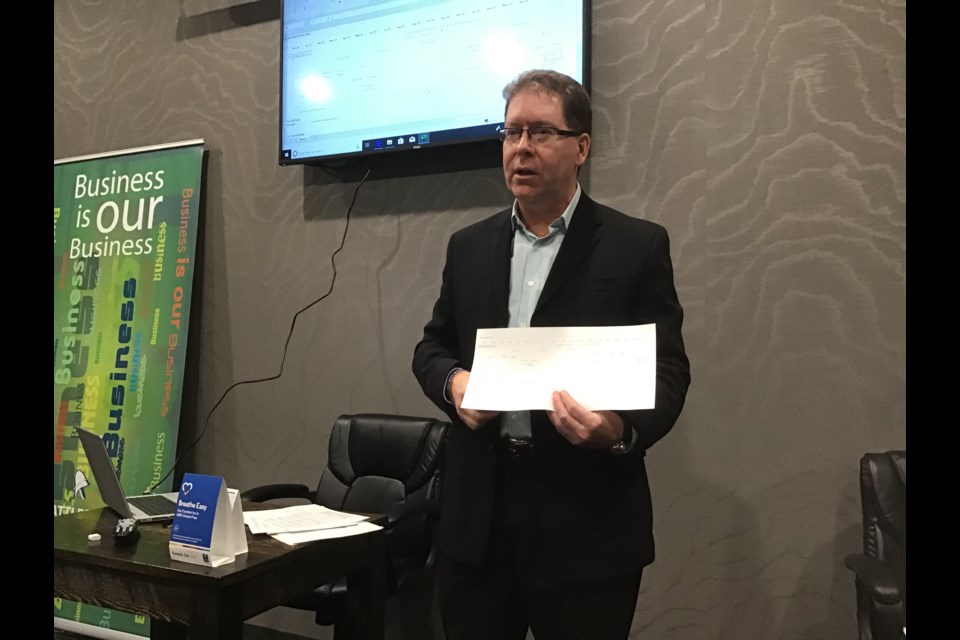

On Friday morning, Oct. 25, it was Battleford director of finance David Gillan who spoke on municipal taxation. It was a lengthy discussion that included discussion of the finance cycle, balance sheets, surpluses, and capital spending.

His presentation began with a look at the municipal finance cycle. The cycle starts in January and goes on for 18 months, with budget planning sessions begin in August and then budget preparation begins in September, with the budget then going to council in November-December for discussion and approval. The tax bylaws are passed around May of the following year May and tax billing goes out around May or June.

The financial statements are done at that same time and according to Gillan it is all connected.

“There’s a link between budgeting and financial statements. There’s a link between the next budgeting and those financial statements, it’s called reserves,” said Gillan. “Things that we do in municipalities aren’t done in isolation. They are done with the big picture in mind.”

There was discussion of the tax tools available including the mill rate and base taxes. Gillan pointed out that base taxes are used by many small and medium sized municipalities but not by Saskatoon or Regina.

Gillan said he would ask officials in the bigger cities why they didn’t use base taxes and “they looked as if they sucked a lemon,” Gillan said. The reason cited by those officials was that is it isn’t seen as a fair system.

Gillan gave some examples of what the difference would be between a $200,000 assessed home and a $400,000 home with or without a base tax. With a $1000 base tax imposed, the tax bill for the $200,000 property would be $2,600; for the $400,000 it would be $4,200.

Without base taxes and with everyone paying based on a mill rate, the bill would be $2,267 for the $200,000 property, and $4,533 for the $400,000 property --- quite a difference, Gillan noted.

“That is a very small example that is hotly debated about its effectiveness and its fairness,” Gillan said.