NIPAWIN — The tax rates have been set. Those that own a home with a total assessment of less than $117,110 will save money this year, while those above that will pay more.

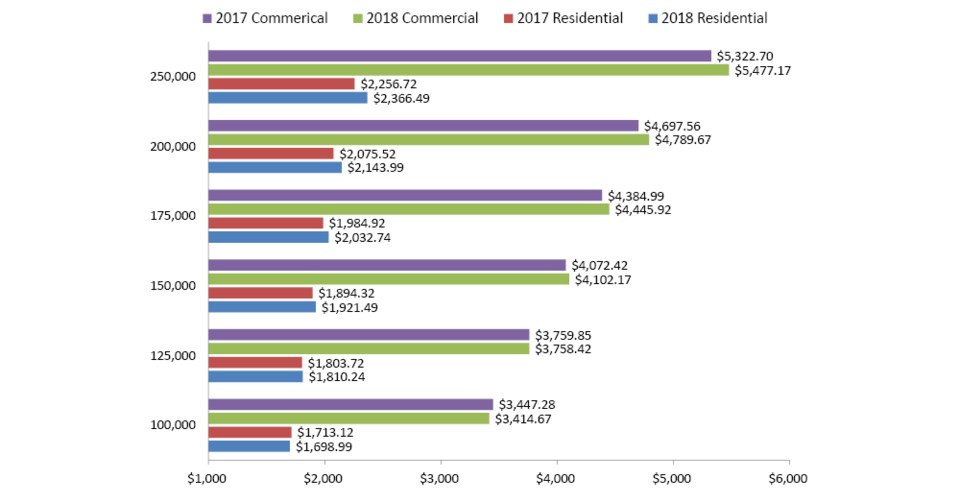

The residential tax rate is 0.445 per cent of the total assessment plus a base tax of $1,253.99. Last year it was 0.3624 per cent of the total assessment plus a base tax of $1,350.72. A home owner with a $100,000 property will pay $1,698.99, a $14.13 decrease; a owner of a $125,000 property will pay $1,810.24, a $6.52 increase; and a owner of a $150,000 property will pay $1,921.49, a $27.17 increase. For every $25,000 increase in the assessment, the increase goes up another $20.65.

The average Nipawin home is worth about $120,000.

Nipawin council is in the second year of a major tax reform that aims to reduce the base tax, which everyone has to pay the same amount, while increasing reliance on the mill rate. That means the taxes will increase more the more expensive the property is. The goal is to lower the base tax to a level that only pays for the town’s essential services.

Barry Elliott, the town’s administrator, said council heard a lot of concern from many sources about the first year of the reform, which was implemented last year.

“They certainly took a good hard look at the philosophy of reducing the base tax. They have stayed the course in terms of continuing to work towards reducing the base tax,” he said. “They slowed it down a little bit this year largely because of the overall effect from last year’s revaluation. They just didn’t want to be too dramatic in making too large a step.”

Commercial properties will pay 1.375 per cent of their total assessment plus a base tax of $2,039.67. Last year they paid 1.2503 per cent plus a $2,197 base tax. Commercial properties worth less than $126,150 will pay less while those above that will pay more.

One concern from last year was commercial businesses were paying more than their fair share. In 2017, residential taxpayers paid 69.17 per cent of the town’s total tax levy and commercial paid 27.71 per cent. This year, residential taxpayers will pay 68.48 per cent of the levy, while commercial will pay 27.77 per cent.

Elliott said council will examine the net effects of this year’s tax levy when they start planning for next year’s budget in the fall.

Discounts and penalties

The town has also changed how it gives discounts to those that pay taxes early and penalizes those that pay late.

Taxes are due July 31. Those that pay in January will get a reduction that’s equal to the Diamond North Credit Union prime rate as of Dec. 31 minus 0.5 per cent. In February, it will be the prime rate minus one per cent, while in March, it will be the prime rate minus 1.5 per cent.

“It’s a larger discount at the beginning of the year, so there’s more of an incentive to pay early,” Elliott said.

For the last five months of the year, there will be a penalty charge equal to one per cent of the unpaid taxes. That will increase by one per cent each month.

Elliott said the changes make the discounts and penalty system more consistent.

“In the past we had three months where there were adjustments made and they were a little larger,” he said. “This sort of levels it out so if somebody pays a little bit late, they’re not paying as big of a penalty or if they’re paying early, they’re still getting a pretty good deal.”

.png;w=120;h=80;mode=crop)