SASKATOON - SaskTel released its 2024-25 Annual Report on Monday which highlighted the competitive environment that the provincial Crown must deal with.

Financial results for 2024-25 saw net income for SaskTel of $82.2 million, down from 95.4 million the previous year and a fourth decrease in a row. The operating revenues was $1,364.9 million — an increase of $16.4 million.

According to their news release, almost half of SaskTel’s revenue is from wireless network services and equipment revenue at 49.5 per cent). Fixed broadband and data services make up 23.4 per cent, wireline communication services 10.6 per cent, and maxTV service 7.2 per cent.

SaskTel is also reporting a return on equity of 6.2 per cent, an EBITDA margin of 26.5 per cent, and a debt ratio of 56.5 per cent which is a increase of 50 basis points from the previous year.

Also going up was the overall net debt to $99.2 million. SaskTel is saying this is primarily to fund continued investment in its fibre and 5G networks.

In terms of capital investment, the total was $398.5 million with spending on wireless including 5G, LTE, and Wi-Fi making up $130.1 million of that. Another $108.5 million was invested in SaskTel's Fibre-to-the-X program.

"In a time of evolution and change in the telecommunications industry, one thing that remains constant is SaskTel's commitment to empowering Saskatchewan people, organizations and communities to reach their full potential," said SaskTel President and Chief Executive Officer Charlene Gavel in a news release.

"Thanks to the substantial investments made in 2024-25, our ongoing progress toward bringing SaskTel's 5G and infiNET networks to more communities is already driving new economic activity and helping to ready our province for whatever comes next in the tech landscape."

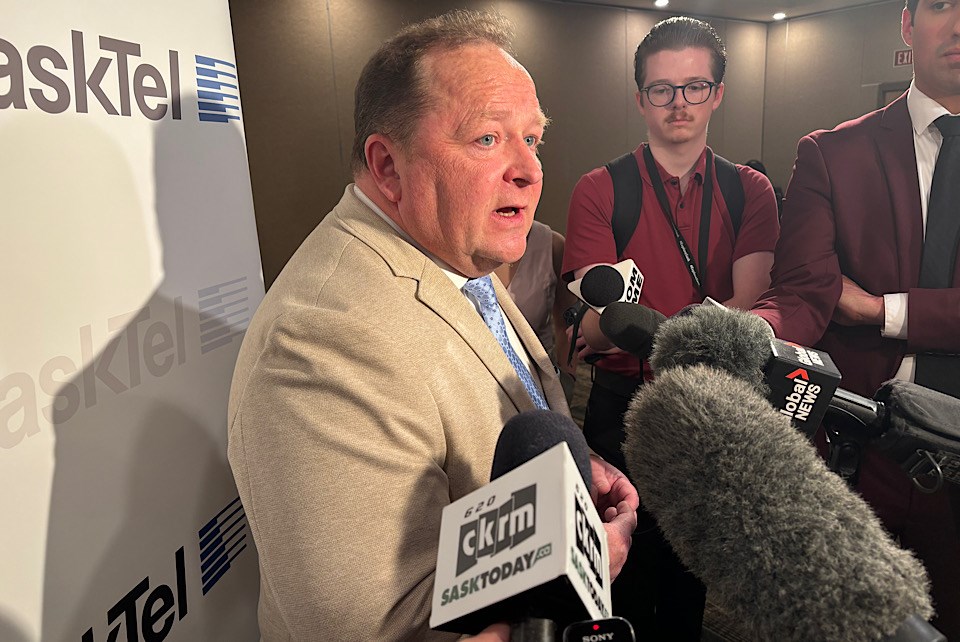

Jeff Welke, Director of Corporate Affairs, noted the challenges facing SaskTel in a competitive environment in speaking to reporters.

“Absolutely -- very competitive marketplace,” said Welke. “I think probably the thing that people see most often is competition on the wireless side. I think we all see the big players that are in here, the Bells, (the) Teluses, the Rogers. There's all kinds of competition that way. There's always emerging competition on the internet side as well.”

Still, Welke said they were “well positioned. We're keeping our market share quite strong and we do compete in a very, very hot telecommunications marketplace in our province.”

One of the challenges Welke noted was a challenging regulatory environment with policies set out by the CRTC.

“The CRTC is not new. However, there are times where we disagree with the policy. We disagree with having to open up perhaps our network to competition at rates we don't set. So, those are the kinds of things that happen in that environment and it makes it yet another business challenge for us, but one we're going to take on.”

Another challenge is that revenues are down on landlines. When asked at what point SaskTel would not offer maxTV service on landlines, Welke said there is “a regulatory basic service offering, so that's there for people that have and maintain a landline. And that's a reality in parts of the province.”

He did acknowledge SaskTel was looking at when that changeover could be made and fulfill the regulatory requirements. “So, you know, that day is coming. It's not around the corner, but it's coming down the pike eventually.”

Welke was also asked if Starlink was eating into the rural customer base. Welke made it known their rural offerings are not something mandated, but one they are providing to customers.

“We're going up to communities quite frankly that none of our competitors would,” said Welke.

“Starlink is a competitive offering out there. However, fibre is the gold standard. Fibre is more reliable. It's faster. There are no gaps. So, we have a great product that we're trying to deliver. I mean, it's expensive to deliver in rural and remote. So, we are looking. We always look for funding from the federal government for those. We were fortunate to achieve some of that last year.”

As for how SaskTel plans to stay profitable and make investments while continuing to give a good rate to customers, Welke said they were “going to have to really work hard to do that. We're going to have to work on being an efficient company. We're going to have to see what the rates come out as, the final rates with that decision. But we're here to compete and we're certainly poised to do that.”