The two most asked question that we field at MineralRights.ca are, “I received an offer to lease my mineral rights for X dollars and Y royalty rate, is that a fair offer?” or “What are mineral rights leasing for in this market?” Both of those questions are impossible to answer in the current state they are presented. From a technical perspective, fair market value for leasing mineral rights is derived from engineering and geological analysis of the quarter section of interest. There is no magical “one value suits all” that covers leasing metrics within a specific region. If you receive an offer that is higher or lower than a neighbour, typically the reason for the difference is an engineering or geological interpretation of the mineral rights of interest. The most intriguing and differentiating aspect of oil and gas exploration is one’s technical (geology and engineering) interpretation of opportunities vs. another’s interpretation; which continually evolves with technology. Put simply, there is no easy answer to either questions above. If you are unsure that you’re receiving fair market value (defined as a price for an item to which a buyer [lessee] and seller [lessor] can agree), do as much research as you can and negotiate with your best interest in mind.

Dec. 1, 2015 is Saskatchewan’s last Crown land sale of 2015 which, to date, has generated approximately $45 million of revenue to the government, down from approx. $197.87 Million in 2014.

Another question is, “Why do crown land parcel typically receive higher bids than freehold mineral right lands?” As mentioned last month, government entities tendering process is designed to generate immediate revenues while maximizing economic activity (not strictly royalty revenues) for the citizens of their respective province. The government does this by implementing a royalty regime with a low upfront royalty (2.5 per cent in Saskatchewan) for a specific production volume, thus promoting investment and allowing the oil company to retain a higher portion of profits to recover its substantial capital investment. A freehold mineral right owners mandate is simple, create the highest amount of economic benefit as possible, to the owners of the freehold mineral rights.

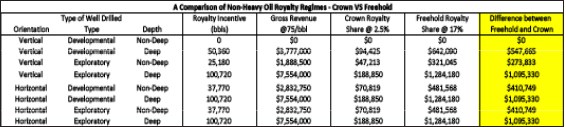

The following table shows an economic comparison, from a royalty revenue perspective, between Crown-owned royalty regimes and the standard freehold royalty regime.

Let’s look closer at our opinion of the least risky well an oil company can drill; a non-deep developmental horizontal oil well. This well type receives a royalty incentive of 2.5 per cent on the first 37,770 bbls of production generated from the well resulting in Crown royalty revenue of approx. $70,818. Assuming a freehold royalty rate of 17 per cent, that same well generates the freehold royalty owner approx. $481,568 or a difference of $410,749. If the oil company drills three wells on that quarter section of land the additional royalty cost to the oil company is $1,232,246 compared directly to the Crown royalty regime.

This royalty difference is why oil companies pay a higher upfront value for Crown mineral rights VS freehold mineral rights.

From all of us at MineralRights.ca – have a happy and safe holiday season!

Watch for next month’s publication – Tips on Effectively Monetizing you Mineral Rights.

Cameron Wyatt is the founder of Homestead Energy Ltd and MineralRights.ca with 15 years’ experience in the industry. He can be reached at [email protected].