Estevan administration says the financial statements presented to council on July 21 show the City is moving in the right direction. There may just be a few more years of debt payments before Estevan will see a true surplus budget.

The audited financial statements for the City of Estevan in 2013 were filed by MNP during a regular council meeting that gave a complete picture of the City's finances. While the City overall was in deficit for 2013, City manager Amber Smale said there are some positives to find when reviewing the financial audit.

"Right now, what was very clear from the consultants is that we're heading in the right direction," said Smale, who added, "There's still a lot of work to be done and still a lot of improvement that can be made, but they were really pleased with this particular audit and the direction we're starting to go."

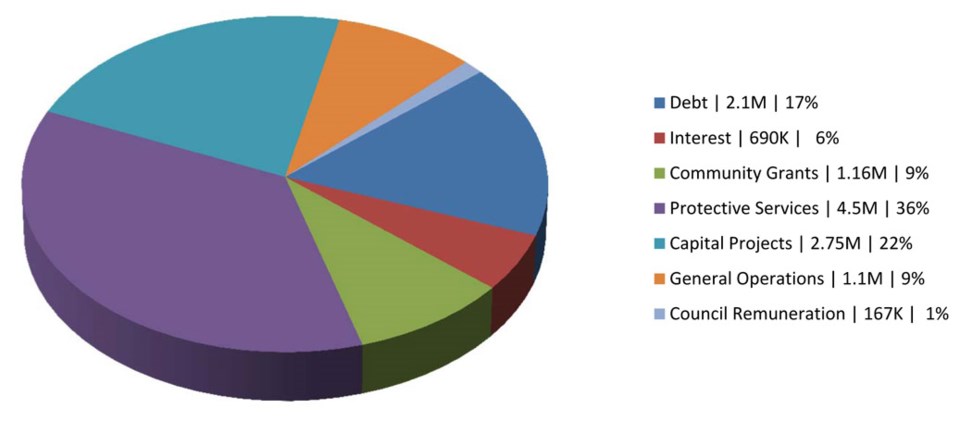

While the City's financial picture appears stable, it's the annual debt payments that loom large over the rest of the budget. Contributing to about 17 per cent of the total budget, principal and interest payments on the City's debt wipe out a 2013 year that would otherwise have the City sitting in the black with a $3.3 million net surplus, an increase from $1 million in 2012.

"That gave council a little bit of comfort, and it should give the public comfort as well," said Smale.

The City has been sounding the belt-tightening alarm thanks to its debt payment schedule. In the 2014 fiscal year, the City will pay just over $4 million in principal and nearly $788,000 in interest.

"The financial statements are showing (a surplus), but what is not applied is the actual cash balance, which includes the debt and the interest. Definitely moving forward, we want a surplus," said Smale. "Eventually the surplus will become real. That's what I mean about changing those statements a little bit so the public understands, so that they can see that when we do have a surplus, we actually have cash in the bank."

Smale said as a percentage of the budget, how much the City pays annually to its loans may vary over the next few years.

"It might shift. It could always shift if we change services around in the way that we're capturing them. Once the debt is gone then (expenses) go more toward operations."

"It's a balancing act moving forward," Mayor Roy Ludwig said, who stressed council is determined to "wrestle the debt to the ground."

Ludwig said the financial statements make it clear that debt will continue to be at the forefront of councillor's minds for the foreseeable future.

"As long as we're carrying debt we should always have monies going toward the debt. Until we get it paid down, of course it will be council's decision, but in most cases once the infrastructure needs are met, we also have a certain percentage that (City Treasurer Jeff Ward) has in mind to put toward debt to keep it under control, and not only under control but being paid down," said the mayor.

The audit provided a breakdown of revenues and expenses in each department at City Hall and Ludwig said that gives the public a plain view of what costs are necessary, while pointing out the City isn't looking to significantly increase budgets.

"Our eyes are wide open to what we have to spend but other than that, we aren't looking at any extra frills," said Ludwig. Total operating expenses at the City grew by about 10 per cent or roughly $3 million from 2012 to 2013, from $28.1 million to $31.1 million.

Ludwig noted the City is constantly looking at budgets and works closely with their auditor throughout the year.

"We've been working very closely with MNP, sometimes even between audit times, for advice," noted Ludwig. "That says it all, how council is committed to paying down the debt."

In the future, the annual release of the City's financial position may have some alterations to the formatting in order to ensure clarity and transparency.

"Just to make it clear so the public can understand the numbers a little bit better and where everything's going," Smale said, "and just presenting the information differently so it captures all the elements that feed into that."

Smale also noted the City has never applied for a Standard and Poor's credit rating, but that may be something they can look into in the future. She said there is a lengthy application process to have S&P review the City's credit, but knowing that would be helpful.

"I don't think we actually know what our credit rating is, but it's something I think we need to know," said Smale.

With issues arising out of the City of Regina regarding the public employee pension plan, Smale said Estevan is in an entirely different position when it comes to servicing the retirement plans of former City workers.

"Regina's is much different than what Estevan's is. We're actually under the Municipal Employees' Pension Plan (MEPP), so we don't even run it ourselves. We simply pay into it," said Smale.

The MEPP is a plan administered by the Public Employees Benefits Agency, an agency under the Saskatchewan Ministry of Finance that handles a wide range of public-sector pension plans. The MEPP provides retirement benefits to employees of both urban and rural municipalities as well as regional colleges, school divisions and other local authorities within the province.

Smale noted Regina's was restructured in the 1970s as their own plan with five employer groups.

"All the decision making around that pension plan rests with the employees, where it's not the same here at all."