MOOSE JAW — Taxpayers owed over $3 million in total tax arrears at the end of the third quarter, which was over 40-per-cent more than Q3 2023, while fewer people participated in payment plans.

City administration presented the third-quarter financial report during the Nov. 25 regular city council meeting, which included data about tax arrears, outstanding debt and how much each property class owed.

Council voted unanimously to receive and file the report.

Property tax arrears

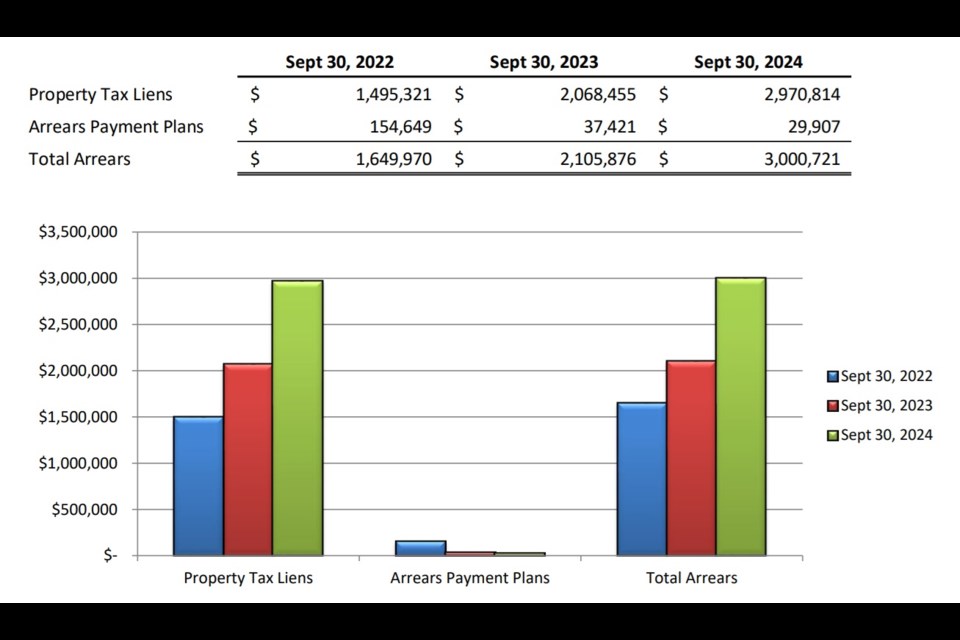

As of Sept. 30, taxpayers owed $3,000,721 in total arrears, which included $2,970,814 in property tax liens and $29,907 in payment plans, the report said.

Conversely, by Sept. 30, 2023, those numbers were $2,105,876, $2,068,455 and $37,421, respectively.

Therefore, the total outstanding amount of tax arrears increased by $894,845 — a jump of 43 per cent — from Q3 2023 to Q3 2024. This comprised a year-over-year increase in liens of $902,359 and a decrease in payment plans of $7,514.

Meanwhile, by Sept. 30, 2022, taxpayers owed $1,649,970 in total arrears, including $1,495,321 in property tax liens and $154,649 in payment plans.

“We continue our tax collection efforts and working with people on payment plans … as we move through that process,” finance director Brian Acker said. “The unfortunate reality is that a lot of people are suffering financial hardships and we’re seeing it reflected in some of our tax arrears.”

Affordability and inflation are the biggest issues city hall hears from people who can’t pay their taxes on time, he added.

Coun. Patrick Boyle thought the increase was “alarming,” and while he understood that some people faced economic challenges, he noted that most everyone else paid their taxes on time. Therefore, he wondered if the city took property titles and sold them.

The municipality will apply a lien to an affected property, which must be paid first if that land is sold, while it will take properties and sell the titles if it reaches that point, said Acker.

There is a “significant commercial property” with outstanding taxes that the municipality is preparing to take and sell, he added. However, such actions are a last resort, while administration’s preference is for residential and commercial owners to pay their taxes.

Property taxes receivable

Property taxes receivable consists of tax arrears and taxes owing. Tax arrears are overdue taxes, while current taxes are due but have not fallen into arrears. Taxes fall into arrears in the next year following the levy of taxes.

The total outstanding property taxes receivable by Sept. 30 was $12,664,037, which included $9,663,316 in current arrears owed and $3,000,721 in outstanding arrears.

In comparison, total property taxes receivable that were outstanding by the end of Q3 2023 were $10,191,651, followed by $9,714,292 in 2022, $985,332 in 2021, $9,267,856 in 2020 and $8,249,804 in 2019.

Arrears by property classes

At the end of 2023, the seven taxable property classes owed $1,547,202.35 in outstanding arrears, while that number was $1,423,611.66 in 2022, the report said. This means those classes have owed $3,000,720.78 during the last two years.

The arrears owed in 2023 and 2022 and the totals were:

- Other agriculture: $0 / $0 / $0

- Commercial/Industrial: $566,637.91 / $363,993.94 / $930,631.85

- Elevators: $0 / $0 / $0

- Multi-unit residential: $145,667.62 / $104,160.05 / $249,827.67

- Non-arable (range): $385.09 / $0 / $385.09

- Railway right-of-way and pipeline: $0 / $0 / $0

- Residential: $834,511.73 / $955,457.67 / $1,789,969.40

Compared to commercial/industrial, residential comprised roughly 59 per cent of all outstanding arrears by property class, the report said.

Borrowing/debt

As of Sept. 30, city hall was still repaying on six projects after borrowing money to finance them.

The principal outstanding amount on each project was:

- Multiplex long-term loan: $10,591,000

- Waterworks capital long-term loan: $20,046,000

- High-service pumphouse: $6,884,000

- Buffalo Pound Water Treatment Corporation (BPWTC) loan term loan (Bank of Montreal): $9,552,660

- Buffalo Pound Water Treatment Corporation loan term loan (TD Bank): $14,185,019.68

- Buffalo Pound Water Treatment Corporation loan term loan (Royal Bank of Canada): $14,231,073.61

These projects totalled $75,489,753.29, an increase of $13,431,073.61 from the end of the second quarter, mostly due to the RBC loan. Meanwhile, the City of Moose Jaw’s debt limit is $95 million.

The next regular meeting of city council is Monday, Dec. 2.

Editor's note: This story has been updated to reflect more accurate numbers.

.png;w=120;h=80;mode=crop)