Regina – By significant margin, last year was the safest year on Saskatchewan roads, ever since SGI started keeping track in the 1950s.

That was evidenced by SGI’s annual report, released in Regina on July 9 by Minister Responsible for Saskatchewan Government Insurance Joe Hargrave.

Hargrave said, “2019-2020 will be remembered as a year Saskatchewan achieve traffic safety milestone.”

“Going back to the 1950s and our earliest recorded stats, 2019 was the province’s best year on record.

“In 2015, the province set a five-year target to reduce both injuries and fatalities rose by 30 per cent. Not only did the Auto Fund exceed those numbers, it did so two years ahead of schedule. As we announced last month, those reductions include the lowest number of impaired driving fatalities and injuries in our province’s history.”

He noted the fight is not over, but it shows “Many people are making better choices.”

There was also a significant decrease in distracted driving after fines were doubled for first time offences, according to Hargrave. He said, “In November, even before those penalties took effect, starting in February, we saw a sharp drop in the number of monthly distracted driving offenses.”

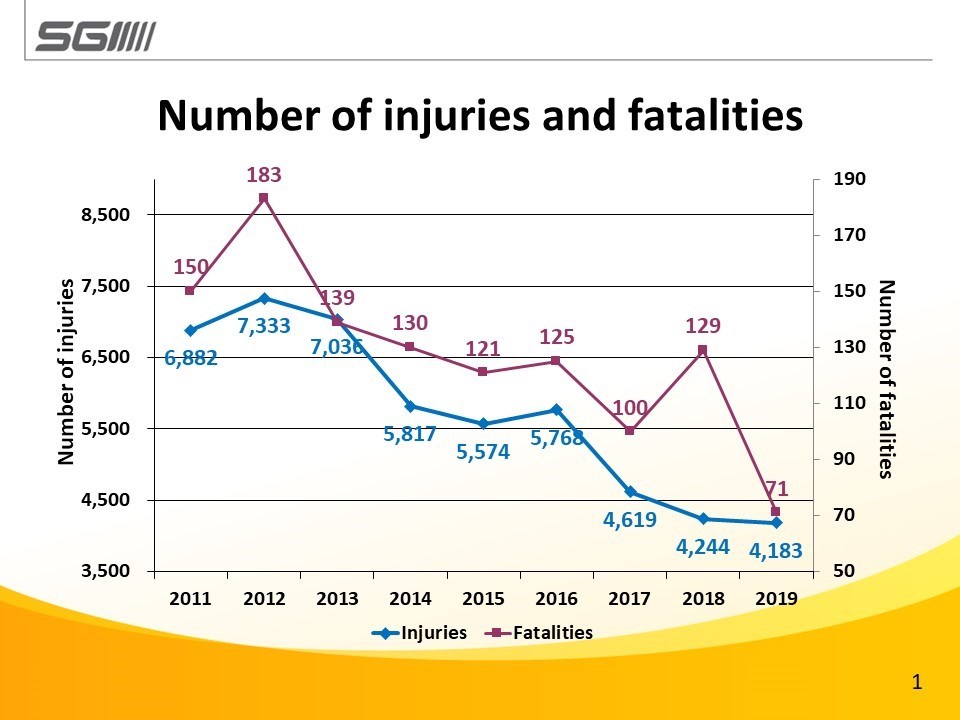

The net result is that in 2012, Saskatchewan saw 183 fatalities and 7,333 injuries. By 2016 there were 125 injuries and 5,774 injuries. In 2019, the number of fatalities fell by 45 per cent compared to the previous year, to 71. There were 4,183 injuries in 2019, also record low.

Hargrave attributed some of this to safer driving practices and safer vehicles. He spoke about his father rarely wearing a seatbelt, and now his own grandchildren insist on it before a key even enters the ignition.

There were actually two annual reports – one for SGI Canada, which is competitive and profit-driven, and the Auto Fund, which is not. It runs on essentially a break-even basis.

SGI Canada saw noticeable growth, with $1 billion in premiums written, of which $581.5 million was in Saskatchewan. The rest was from Ontario to the West Coast.

That billion dollars is up $84 million from the year before. Indeed, the nearly 20 per cent annual growth of sales in Alberta saw the Crown corporation actually slow down in that market and pursue other markets, like British Columbia and Ontario, more aggressively. This was done to reduce the risk of prairie storms having too much of an impact. The net income for SGI Canada was $49.9 million.

A dividend of $54.3 million was paid to the provincial treasury the highest dividend this decade. The difference between net income and dividend was based on the “industry standard minimum capital test,” which meant that SGI Canada had more money available to pay in dividends. Last year SGI Canada paid a $13 million dividend.

COVID-19 impact

Pre-COVID, SGI Canada was on track to actually earn an additional $40 million from its investments. The market bottom coincided almost exactly with the fiscal year end, however, resulting in just $54.3 million in investment earnings.

The Auto Fund is set up so that its premiums don’t actually cover all its expenses, including payouts. The difference is made up for by profits from its investment profile, the Rate Stabilization Reserve.

The COVID-19 crisis and its impact on stock markets hit those investments hard, with the fund seeing a $200 million hit at its low point on March 23. However, markets have since recovered and made up for most of that $200 million.

“Customers can breathe a sigh of relief when it comes to insurance rates. They have not, and will not, experience the kind of increases that drivers in other provinces, over the past have had in the past few years,” Hargrave said.

He noted that more than 90 per cent of SGI’s workforce had been working from home during the lockdown. He credited extensive planning and excellent leadership for the “relatively seamless” transition for employees and customers.

Fewer auto damage claims

While the number of damage claims per 1,000 customers has declined from 131 in 2018 to 119 in 2020, the cost of damage claims has remained consistent over that time frame, at $547 million in 2020, and $552 million for each of the previous two years. The cost of repairing increasingly complex vehicles has been increasing, with a 5.1 per cent 10-year compound growth.

Similarly, injury claims per 1,000 customers has fallen from 6.9 in 2011 to 4.8 in both 2019 and 2020, but the payout has been relatively flat, at $244 million for 2020.

Commercial drivers

This past March marked the one-year anniversary of the implementation of new mandatory training standards and higher testing standards for commercial semi drivers. Those were implemented in the aftermath of the Humboldt Broncos bus crash. All new semi truck drivers are now monitored more stringently for one year post-licensing.

Hargrave said, “Since the 121.5 hours of mandatory training for Class 1 we've had about 800 applicants, or 800 people, go through the through the training.”

He noted there about 60,000 Class 1 license holders in the province, and thus the 800 is too small a number to see any effect yet. “We are very positive, with the work that we've done not only Saskatchewan, but in with the other provinces in Canada, especially in the West, that this will have a very positive effect on the accident rate in Canada. Hopefully we'll have fewer accidents, and most importantly, fewer deaths and injuries from it, but we're very positive.

“We’re speaking with the trucking industry. They're very positive that this training is going to have a long term, positive impact on their industry,” Hargrave said.

.png;w=120;h=80;mode=crop)