Some Estevan homeowners were on the receiving end of both good and bad news last week.

The City of Estevan began sending out 2013 assessment notices to residents to inform them of what their property has been valued at by the Saskatchewan Assessment Management Agency. SAMA reassesses property every four years for taxation purposes.

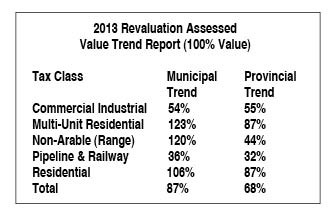

In what is another reflection of the financial boom in the city, residential property values in Estevan increased by an average of 106 per cent over the past four years, which is well ahead of the provincial average of 87 per cent.

However, that does not mean property owners will see their taxes rise significantly as the City said it will try to make any assessment revenue neutral.

"If the average is 106 per cent, council, before they apply a mill rate increase would go back to a mill rate that would provide the same amount of taxes as last year and then they would put a new mill rate on it," said city manager Jim Puffalt.

While that news is good for those whose values rose by the 106 per cent average, there are a number of homeowners whose taxable assessment rose well above that mark and they will see an increase in their taxes.

City Tax Assessor Trina Sieben says older homes in Estevan were hit particularly hard as their values were adjusted to reflect the current market climate. According to some anecdotal reports, the increases have been in the 125 to 150 per cent range depending on the home.

"In 2009 we didn't have enough sales to bring them up to where they are now, whereas in the last five years, the market for all houses has increased drastically."

Sieben added that when the last reassessment was done in 2009, it used a base date of 2006 with respect to market values for homes. For the 2013 assessment the base date was January 1, 2011.

"This is bringing the values closer to what the market would have been at that time," Sieben said.

When it comes to assessing value on a property, Sieben said there are a few different approaches taken. Commercial and multi-family properties are assessed on the property income approach while residential properties are done on the sales comparison report.

According to the information that was provided to taxpayers with their assessment notices, the property income approach is based on the premise that the value of the property is directly related to the rental income it will generate. The appraiser analyzes the property's ability to produce a future income stream and then estimates the property's value.

The sales comparison approach is a straightforward process, as it compares what other homes in the same market are selling for.

The average increase in commercial/industrial property was 54 per cent while multi-unit residential jumped by 123 per cent. The value of non-arable land increased by 120 per cent while other agricultural land rose by 92 per cent.

If someone disagrees with their assessment, they will have the opportunity to file an appeal until May 13. The City will also be holding an open house on April 10 where the public can discuss their assessment values.

On a provincial level, the government has announced that it will hold the line on education property taxes this year.

Because the overall value of property in Saskatchewan rose by 67 per cent, there had been some fears of a large tax increase. Premier Brad Wall quelled those worries last week with the announcement the increase would be revenue neutral.

"A few weeks ago, Government Relations Minister Jim Reiter said that our government would take a close look at the impact of this huge increase in property values on property taxes," Wall said in a government release. "I am pleased to announce that despite some significant pressures on our provincial budget, we will hold the line on education property taxes in 2013."

Wall said that means education tax rates will be reduced significantly in next week's provincial budget to keep the overall impact on property taxes revenue-neutral in terms of reassessment.

"That means some property owners will still see their taxes go up because their assessment went up more than average, while others will see their property taxes go down," Wall said. "But overall, we are holding the line on education property tax mill rates."